It started out with a simple Netflix subscription, around $7.99 USD per month to be free from space-hogging DVDs and to leisurely binge TV shows without ads. Sounds great, right?

Well, in reality, 2019 and 2020 look a little (lot) different from a video streaming perspective.

Cord Cutting

Over the past several years many people, especially those of the younger, digitally-comfortable generations, have opted to cut the cord and instead rely on paid video streaming services to get their TV and movie fix.

“Four million households per year are dropping their cable and satellite TV services – cutting the cord and relying on internet alternatives – a trend which should continue for at least the next five years, research firm eMarketer predicts.”

For cable operators, this was a clear disruption to their long-standing business models, but it did give users more freedom, choice, and flexibility to watch what they wanted, when they wanted, and from wherever they wanted. With this new paid-viewing alternative, user-quality expectations also changed – gone are the days where grainy is considered an acceptable streaming resolution.

Aside from the obvious loss of revenue, the cord cutting phenomena has a direct impact on the network, driving up bandwidth demand, causing congestion, and increasing peering costs.

Some operators, ahead of the curve, have implemented different management techniques to help with the side effects of what can be described as “too much of a good thing.”

Market Fragmentation

So, what’s changed? Well, what has been dubbed as the streaming wars has taken this simple, easy, and arguably user-centric model and made viewing options once again difficult and more expensive.

The Sandvine 2019 Global Internet Phenomena Report already shows the early effects of these wars, as Netflix was surpassed by HTTP Media Streaming, a generic streaming protocol.

This fragmentation is expected to only get worse as content giants and streaming services now duke it out for the eyeballs and monthly subscription dollars, once held largely by Netflix, with the likes of Disney+ giving the incumbents a run for their money with a library that boasts more than 7,500 TV episodes and more then 500 movie titles.

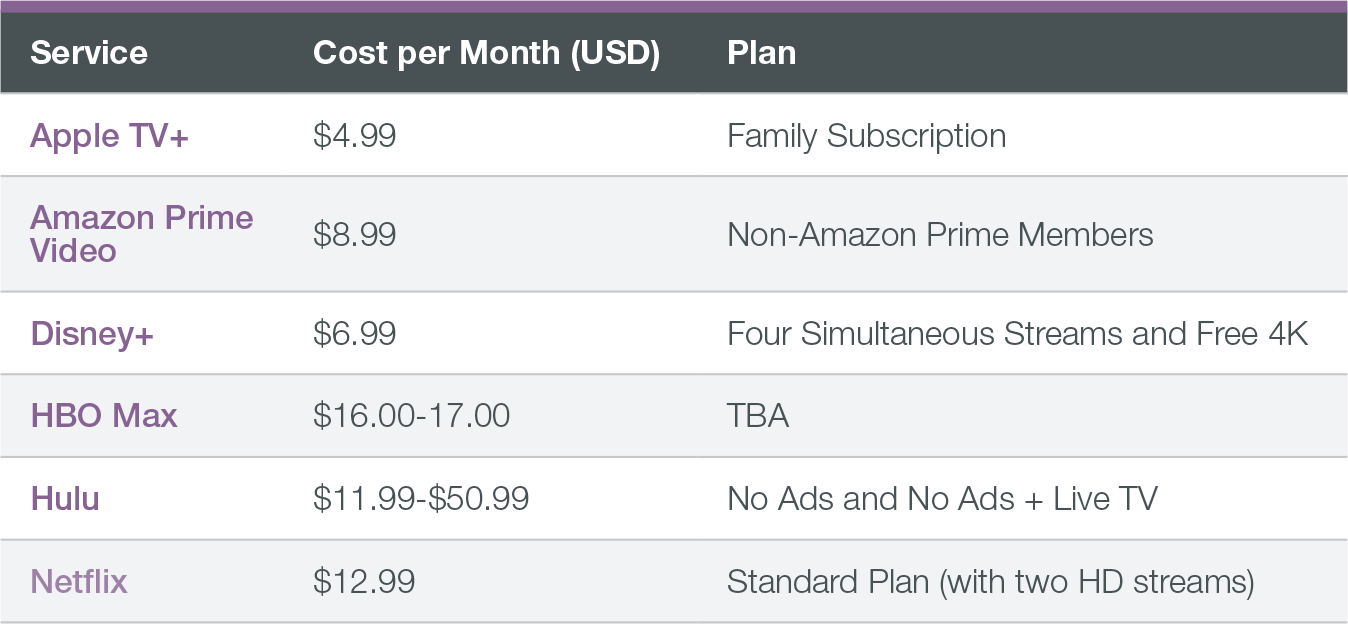

For users this means once again having to pay more than $60 USD per month, begging the question: “how many services does one need to actually keep up-to-date with their favorite series and movies?”

Those who can’t afford these now fragmented services or who live in regions where in-demand content, such as the titles offered on Disney+, isn’t offered will experience a renewed reliance on piracy – file sharing, IPTV fraud, and geo-blocking.

As for the network, which is already dominated by video traffic, managing congestion, costs, and quality is going to become an increasingly difficult problem, one that demands an intelligent solution.

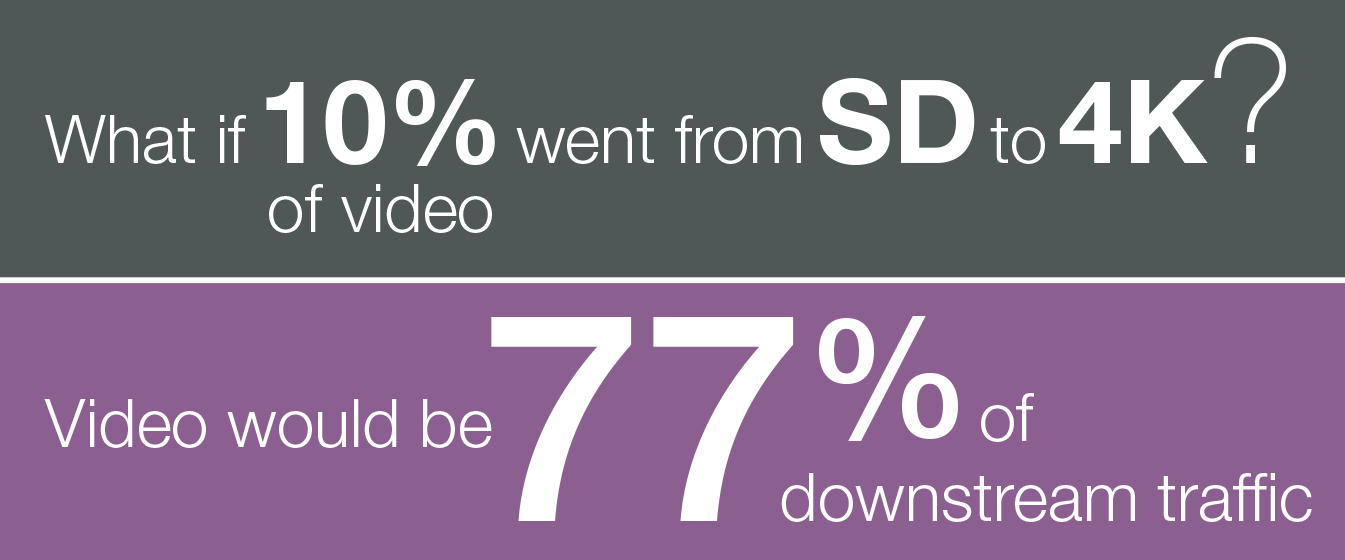

All this fragmentation results in a lot more content – both original and existing – for people to stream. It’s not just an increase in volume that operators need to worry about, but with players such as Disney+ coming out of the gate with 4K streaming for free, small shifts in resolution rates result in big traffic increases.

To help operators manage the new video landscape, Sandvine is releasing a video spotlight eBook – Avoiding the Stall: An Operator’s Guide to Video QoE – covering all the latest traffic and market trends and how to tackle the continued rise of video.

Topics: Video, Netflix, AmazonPrime, Video Streaming, HBO, Hulu, Disney+, 4K, Apple TV+